Data

Client Data set

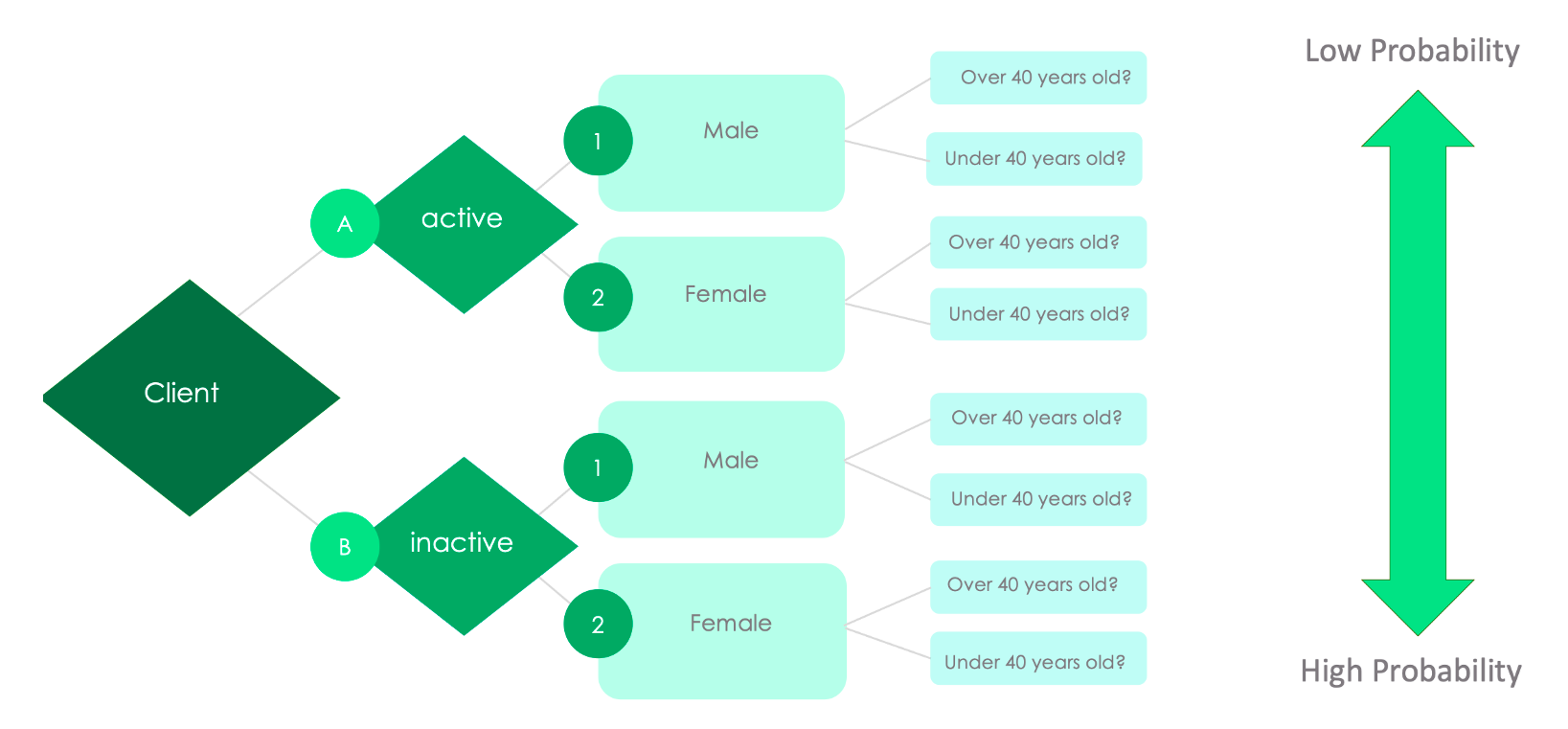

The PIG E. Bank wanted to understand the factors behin them losing clients. I used a data mining mechanism, build a decision tree to predict which clients might leave the bank.

Client Data set

Data sorting, filtering and cleaning, Grouping & sumarizing data, Descriptive analysis, Data Mining, Building a decision tree as a data mining algorithm

Which risk factors contribute to a client's likelihood to leade Pig E. Bank?

The factors inactivity, female and being under 40 years old contribute to a high probability of a customer to leave the bank.